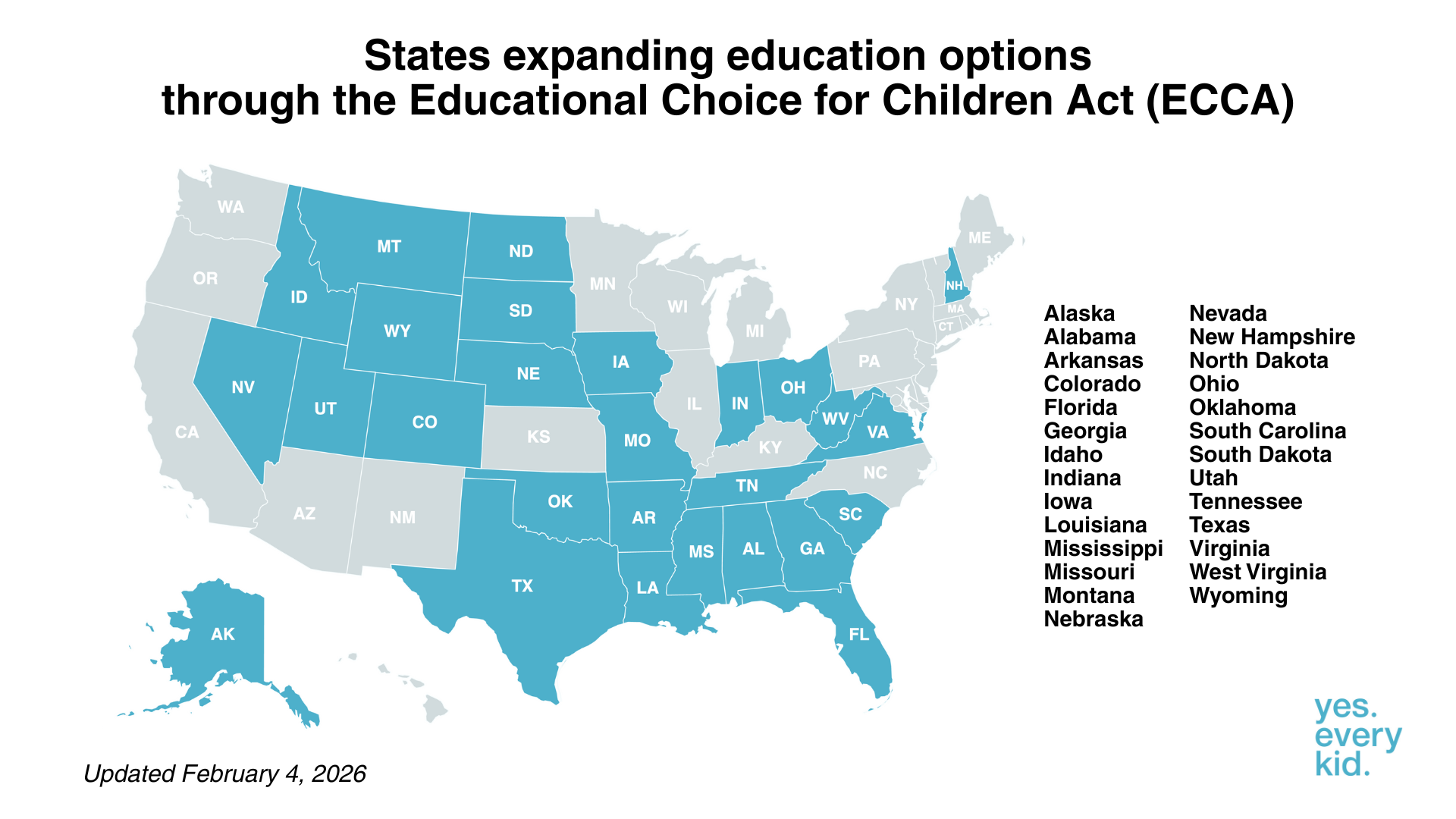

Last Updated: February 4, 2026

From statehouses to governors’ offices, leaders closest to families are opting into the new federal education tax credit program, also known as the Educational Choice for Children Act (ECCA). Their support reflects a growing commitment to empowering families and expanding access to education options for kids across the country.

This new program allows taxpayers to donate up to $1,700 to a scholarship-granting organization and, in return, receive a $1,700 federal tax credit.

A Growing Coalition of State Support

Below is a list of states that have either formally opted in or expressed intent to participate in ECCA.

Alabama

In signing an executive order electing the state’s participation in the Educational Choice for Children Act, Gov. Kay Ivey

Alaska

A spokesperson for Gov. Mike Dunleavy has indicated the state will opt into the tax credit program.

emphasized her administration’s focus on students, stating, “Ensuring that all Alabama students have the opportunity to receive a quality education is a top priority of the Ivey Administration.”

Arkansas

“Arkansas is a national leader in school choice and I’m excited to see that with President Trump back in office, he’s taking the education freedom movement nationwide,” said Gov. Sarah Huckabee Sanders. “Paired with the EFA program established by Arkansas LEARNS, which more than 44,000 students already participate in, this federal scholarship makes sure that Arkansas families have more education options than ever before.”

Colorado

“I would be crazy not to [opt in],” said Gov. Jared Polis. “Fundamentally, it’ll empower more parents to be able to afford that after-school program or the summer program that they want for their kid.”

Florida

“Florida leads the nation in education freedom,” said Gov. Ron DeSantis. “In 2023, we enacted universal school choice to give every family access to school choice options that meet their needs. Nearly half of all students in Florida are now learning in a school choice setting—whether that’s private, charter, virtual, or homeschool. The newly enacted Federal Education Freedom Tax Credit is an opportunity to further support education freedom.”

Georgia

“Now that we have a like-minded partner in the White House with President Trump, I’m grateful that the positive impacts of the Georgia GOAL Scholarship will not only be enhanced by this federal tax credit, but also replicated across the country,” Gov. Brian Kemp said.

Idaho

Gov. Brad Little opted into the federal education tax credit in January “to expand education freedom and the accessibility of educational opportunities for all Idaho students.”

Indiana

“Parents are in charge of their children’s education,” said Gov. Mike Braun. “As a state, we are prioritizing that through universal school choice and a state tax credit for donations made to scholarship granting organizations, which helps make a high-quality education accessible and affordable for every Hoosier family.”

Iowa

“Iowa believes in empowering every student and family with world-class educational options — from our K-12 public schools to public charter schools, accredited private schools, and homeschooling — so they can choose the best place and path for their future,” Gov. Kim Reynolds said. “The Trump Administration’s federal tax credit will complement Iowa’s existing programs, expanding opportunity even further while reinforcing the state’s commitment to school choice.”

Louisiana

“Louisiana is opting in so families can benefit starting in 2027! This is yet another way we’re expanding opportunity and helping every child reach their full potential,” said Gov. Jeff Landry.

Mississippi

“Mississippi believes that parents – not government – know what’s best for their children’s education,” said Gov. Tate Reeves. “The Federal Tax Credit Scholarship Program will help Mississippi continue its historic performance in classrooms across the state and further empower parents to do what’s best for their children.”

Missouri

“Thanks to the One Big Beautiful Bill Act and the work of our federal delegation, Missouri WILL OPT IN to the new federal scholarship tax credit program, said Gov. Mike Kehoe. “Students across our state have brighter futures because their families were given educational choice. They remind us that when we put students first, opportunity follows.”

Montana

“Opting in to this program gives Montanans another incentive to support the success of the next generation,” Gov. Greg Gianforte said. “Thanks to President Trump, we’re building on Montana’s successful programs that provide children with more educational opportunities and we’re expanding education freedom, giving more students and parents the ability to choose the learning path that works best for them.”

Nebraska

“This program is a game-changer for Nebraska students and their families, generating funds that will help send students to the school of their choice,” said Gov. Jim Pillen. “When it comes to educating our kids, we need to ensure that every student is in an environment that allows them to succeed. This program provides that opportunity, and I’m pleased to say that Nebraska will take part.”

Nevada

“I enrolled Nevada into the Federal Tax Credit Scholarship Program to empower families with the freedom to choose education options that best fit their children’s needs,” said Gov. Joe Lombardo. “This program marks a historic milestone for parental freedom and economic opportunity.”

New Hampshire

“New Hampshire continues to invest in educational opportunities for our students, whether it’s historic levels of funding for special education or expanding education options for families,” said Gov. Kelly Ayotte. “We want every child across our state to be in the learning environment that best fits their needs, and this tax credit opportunity will help give families that choice and provide tax relief to individuals. We will continue working to provide a best-in-class education for our kids and ensure students, teachers, and their parents have the resources they need to thrive.”

North Dakota

“This program incentivizes charitable giving to support our state’s most precious resource – its students,” Gov. Kelly Armstrong said. “We look forward to implementing the program with additional federal guidance to empower school choice and support North Dakota students in their education.”

Ohio

Ohio has opted in to the ECCA.

Oklahoma

In signing an executive order electing Oklahoma’s participation in the federal tax-credit scholarship program and establishing a School Choice Hub, Gov. Kevin Stitt emphasized parental empowerment, noting in the order that “parents, not the government, know their children best and are uniquely equipped to choose the school that aligns with their child’s needs, values, and learning styles.”

South Carolina

A spokesperson for Gov. Henry McMaster has indicated the state will opt into the tax credit program.

South Dakota

“Our students are the future of our state, and we must equip them with the skills and resources they need to thrive,” said Gov. Larry Rhoden. “Parents should have the freedom to choose the learning environment that sets their kids up for success. I am grateful that President Trump has the same conviction and is helping us create more opportunities for our students.”

Tennessee

A spokesperson for Gov. Bill Lee said the state plans to participate in the program, calling it “an all-of-government approach to deliver high-quality educational options for families across the state.”

Texas

“Texas has delivered on its promise to bring education freedom to every Texas family,” said Gov. Greg Abbott. “Thanks to President Trump, generous Texans can receive a tax credit for donations to a qualified scholarship granting organization to minimize education expenses for families. This critical program will increase the opportunity for families to choose the educational setting that works best for their child. Texas is proud to partner with the Trump administration to empower parents and ensure a stronger future for our children.”

Utah

“We’re expanding opportunity for families and empowering parents to choose the best education for their children,” said Gov. Spencer Cox.

Virginia

“This decision expands school choice for families across the Commonwealth by opening access to federally tax credit-funded scholarships,” former Gov. Glenn Youngkin said. “It empowers parents and helps ensure students, especially those with the greatest needs, can choose the learning environment that is right for them.”

West Virginia

West Virginia has opted in to the ECCA.

Wyoming

Wyoming has opted in to the ECCA.

Why This Matters

State leaders play a central role in shaping education policy—and their support for new federal education tax credit sends a clear signal that families deserve options that reflect their kids’ needs, strengths, and goals.

As more states add their voices, this page will continue to reflect the growing momentum behind ECCA and the leaders committed to empowering kids through expanded educational choice.

This page reflects public statements from state leaders, including formal opt-ins and expressed intent to participate in ECCA. Check back for updates as additional states sign on.